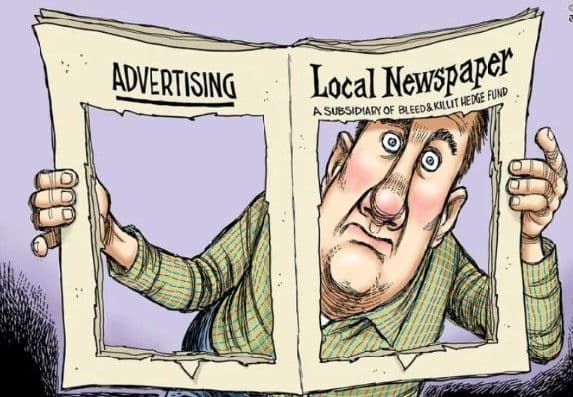

BoSacks Speaks Out: How Alden Global Capital Turned Local Journalism into a Liquidation Strategy

By Bob Sacks

Tue, Feb 17, 2026

Let’s be clear about one thing up front.

Alden Global Capital did not create the collapse of the American news business.

That damage was done years earlier by publishers who mistook monopoly profits for brilliance, ignored the internet, and then responded to disruption with denial and delay.

But Alden did something else, something far more consequential.

It industrialized the endgame.

Alden’s model is brutally consistent. It buys distressed newspapers, slashes newsroom staffing, sells off real estate and assets, centralizes operations, raises prices, and reinvests almost nothing in journalism. The goal is not revival. It is short‑term cash extraction.

By that measure, Alden has succeeded.

By every journalistic and civic measure, the results are devastating.

Consider The Denver Post. Once a nine‑time Pulitzer Prize winner with a robust metropolitan staff, it was reduced under Alden’s ownership to a fraction of its former newsroom. The paper still prints. The institutional capacity that once held Colorado’s power to account does not.

Or look at the New York Daily News. In its latest round of Alden‑era cuts, entire desks were hollowed out, leaving one of America’s most storied tabloids struggling to cover national news at all. The name survives. The muscle memory does not.

This pattern repeats across Alden’s portfolio, from the San Jose Mercury News to the Chicago Tribune to dozens of regional dailies most Americans have never heard of but rely on just the same. Papers don’t close. They linger. They become ghost newspapers, existing in name, absent in impact.

Defenders of Alden offer a familiar response: These papers were already dying.

That’s true, and beside the point.

The real damage Alden has inflicted is not simply staff cuts. It’s the normalization of the idea that newspapers are no longer civic institutions at all. Under Alden’s model, journalism isn’t the product, it’s the residue.

Once that mindset takes hold, boards stop asking how to rebuild trust or relevance. They start asking how much more can be pulled out before the lights go out.

And here’s the uncomfortable truth: Alden could not operate without willing sellers. Time and again, boards chose Alden’s cash‑heavy offers over alternatives that would have preserved local ownership or nonprofit control. Fiduciary duty was interpreted narrowly, highest bid wins, even if the institution is stripped for parts afterward.

Alden didn’t break the rules. It followed them exactly as written.

The cost of that compliance is paid not just by journalists, but by communities. Fewer reporters mean less scrutiny, cheaper corruption, and thinner democracy.

So no, Alden Global Capital didn’t murder journalism. That crime had many accomplices and a long paper trail.

But Alden made sure the body was thoroughly harvested.

And once you’ve watched that happen, market after market, you stop pretending this is just another ownership strategy.

It isn’t.

It’s an end‑of‑life business.